Company Profile

Company Name: Paycom Software, Inc.

Ticker: PAYC

Stock Price: ~$157.65 per share

Market Cap: ~$9.29 billion

Paycom Software specializes in cloud-based human capital management (HCM) solutions, offering an integrated suite that streamlines payroll, HR, and talent management.

BETI ("Better Employee Transaction Interface") stands out as a key feature, enhancing the payroll experience by reducing errors and improving efficiency. This feature not only benefits employees but also helps employers save time and resources.

Key Benefits of BETI:

Error Reduction and Employee Engagement: Employees can verify their pay before processing which increases satisfaction and reduces payroll questions.

Cost Efficiency: Automates payroll reviews, saving time and reducing administrative costs.

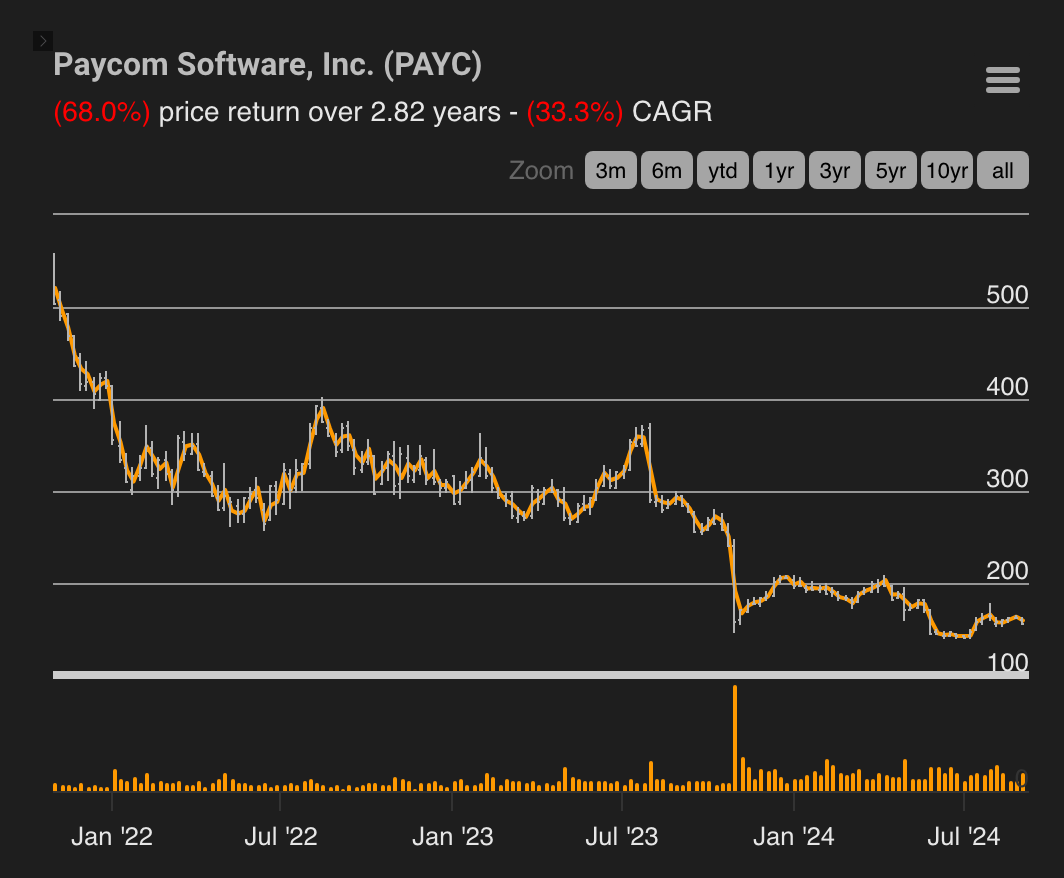

Paycom’s stock has tumbled 45% in the past year and nearly 70% since its peak in 2021. Despite the tumble, Paycom still has strong financials with no debt and potentially has a path toward regaining levels of growth seen previously.

Is this a simple and repeatable business?

Paycom’s value lies in its ability to simplify complex HR processes. BETI is a potential game-changer, allowing employees to check and manage their paychecks, which enhances accuracy and boosts satisfaction. Paycom potentially has a first-mover advantage by launching this product before their competition.

Paycom has around a 94% retention and 98% of their revenue is recurring in nature. Some of their competitive advantage lies in their ability to be a cloud-based solution with a singular database - it is considered a true “all in one” HR solution. There is little customization with the software, so the time to value is quite low, a major positive in the SaaS world.

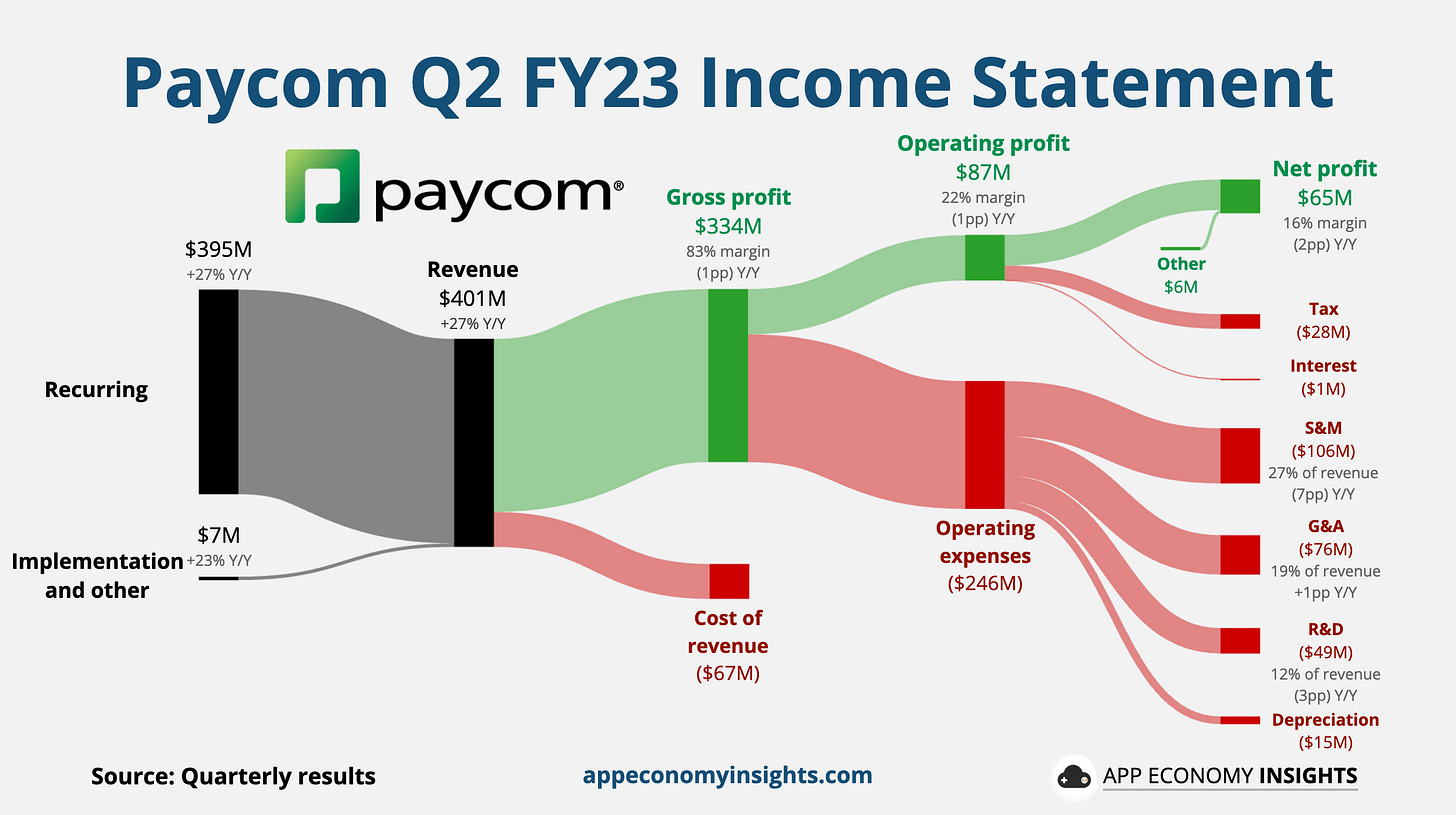

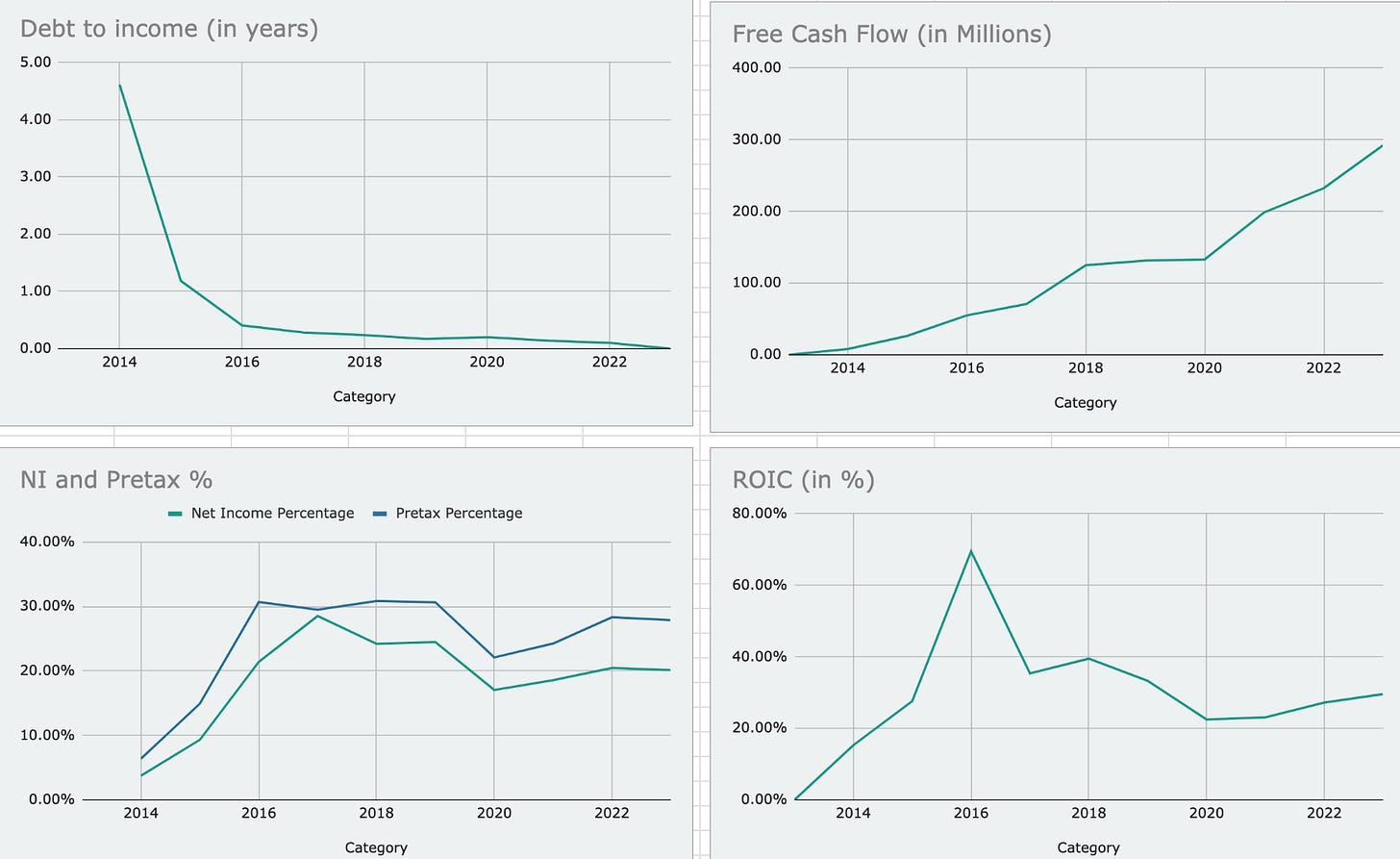

Key Financial Metrics

Competitors

Company 1: Paylocity

Comprehensive cloud-based payroll and HR management solutions

Automated global payroll across 100+ countries

Robust time tracking and attendance management

Learning management system with customizable courses

Company 2: ADP Workforce Now

Scalable solutions for growing and international businesses

International payroll and HR capabilities

Extensive HR and payroll tools

Certified Professional Employer Organization (PEO) services

Company 3: Paycor

User-friendly platform for small to mid-sized businesses

Waived setup fees for new customers

Unlimited, automatic pay runs

Strong time tracking and HR tools

Company 4: UKG Pro

Comprehensive HR, payroll, and workforce management suite

Focus on employee experience and engagement

Advanced analytics and talent management tools

Highly customizable with a steep learning curve

Company 5: Ceridian Dayforce HCM

Single, cloud-based platform for HR, payroll, and workforce management

Real-time payroll calculation and on-demand pay options

Predictive analytics for workforce planning

Mobile-first design for employee self-service

Moat

Paycom’s moat is built on its integrated software solution, which creates high switching costs. BETI further strengthens this moat by embedding employee interactions directly into payroll processes, making it harder for clients to switch providers.

Key Points about Paycom’s Moat:

Switching Costs: High, due to deep integration and BETI’s role.

Competitive Edge: Strong brand and innovative solutions provide a significant advantage including BETI and GONE (recent 2024 winner for “time off” functionality)

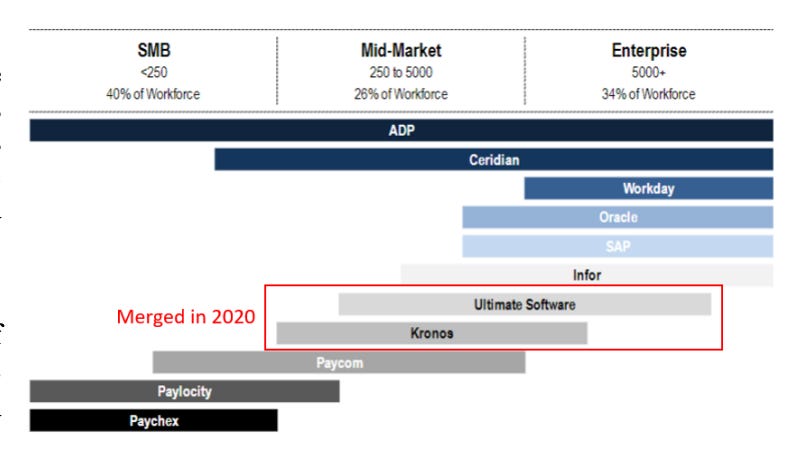

Market Position: Competes with giants like ADP but stands out with its unique offerings.

Market Share

Paycom is looking to move up market to enterprise customers.

Management

Led by Chad Richison, Paycom’s management team has driven impressive growth with a focus on innovation and operational excellence. Richison’s leadership has been crucial in maintaining high ROIC and fostering a culture of success.

He has some negative feedback online, is considered potentially overpaid, and a secretly recorded call (linked below) has shed some negative light on him.

Valuation

There is a relatively wide range of outcomes that Paycom could have over the next few years.

Path 1: BETI is revolutionary, they gain market share, and continue to grow tremendously (along with the share buybacks).

Path 2: Revenue growth continues to slow, and is closer to the industry growth rate (high single digits). Cash flow is still solid, and buybacks still occur (they are looking to buy back $1.5 billion in stock, about 16% of the current market cap).

Path 3: Product issues persist, BETI does not live up to expectations, and revenue / market share falls.

I have priced in somewhere between path 1 and 2, which I think are the most likely with the following models. I think the stock is likely still overvalued by around 33% ($50 per share) when we price in the likelihood of being able to return to such high growth rates.

Risks

Revenue growth is slowing down: BETI is cannibalizing revenue from other parts of Paycom’s business as fewer payroll errors are resulting in less revenue in those services. The counter-argument is that BETI will become the world-class standard, become widely adopted, and competition will have to catch up.

Product Issues: Recently there was an internal phone call that was leaked where the CEO, Chad Richison, discussed his disappointment with his Product team and their development of features. Some would say this shows major issues developing at Paycom, but the counterargument would be that since Chad is still the CEO 25 years after founding the company he is just focused on making things right with his product and company.

Payroll software is a commodity: It could be argued that payroll software is a commodity and that competition will continue to increase a “race to the bottom” regarding price.

Conclusion

Paycom Software is a promising SaaS company with a strong moat, driven by innovations like BETI. Despite its excellent growth metrics, waiting for the stock to approach a more reasonable price could present a more attractive entry point.

I will continue to research BETI and determine its level of disruption. If it is as disruptive as claimed, the stock price could more than justify a solid purchase. I do own a small position in PAYC that I started as I researched the company. I will keep everyone updated if I decide to add more!

Disclaimer

Remember: This is not financial advice! I am not a financial advisor and have not considered your personal financial situation. This analysis is for educational and entertainment purposes only.

I own shares in PAYC, DIS, FLWS, FND, GOOGL, HHH, HPQ, LULU, LVMUY, NTDOY, OXY, POOL, PYPL, SEG