Analysis of lululemon (LULU)

lululemon is a fantastic business I would love to own, I just need it to drop in price a little further.

Note before we begin! LULU’s Market Cap has fallen by over $1 billion dollars since I started writing this analysis last week. Their Chief Product Officer is leaving the company and they are planning a re-org instead of replacing her. Some analysts are predicting that the sky is falling. So the question remains here: can lululemon continue to innovate and grow? Or are they offering a commoditized product in an era of shifting tastes? Are the fears overblown providing an opportunity to scoop this company up for the cheapest P/E ratio it’s traded at in about a decade? Or is this thing in a free fall? Let’s jump into it.

Company Profile

Company name: Lululemon Athletica

Ticker: LULU

Stock Price: ~$320

Market Cap: ~$39 billion

Lululemon Athletica, founded in 1998 in Vancouver, Canada, has evolved from a yoga apparel niche to a global athletic apparel powerhouse. Their product line includes a broad range of athletic wear designed for various activities such as running, training, and yoga.

The company generates the majority of its sales via women's clothing. 84% of their revenues are generated in the United States. Lululemon conducts its business through two channels: 1) Their own stores 2) Direct-to-consumer (e-commerce).

Industry Overview

Industry: Consumer Discretionary // Specialty Retail

KPIs:

Same-Store Sales (SSS): Indicates organic growth by comparing sales of existing stores year over year.

Inventory Turnover: Reflects how efficiently the company manages its stock.

Customer Acquisition Cost (CAC): Measures the expense of acquiring new customers.

Customer Retention Rate: Indicates customer loyalty and satisfaction.

Digital Sales Growth: Tracks the performance of online sales, a crucial area for modern retail.

Brand Reputation: A qualitative measure that impacts customer loyalty and sales.

Lululemon operates in the highly cyclical Consumer Discretionary industry, which thrives during economic booms but suffers during downturns. This sector demands constant innovation and adaptation to consumer trends.

Growth Prospects

Despite the industry's cyclical nature, Lululemon's focus on quality, brand loyalty, and community engagement positions it well for sustained growth. They plan to execute this plan by focusing on product innovation, enhanced customer experience, and international expansion.

This is what they have to say about growth: “We remain committed to our Power of Three ×2 growth plan, which is grounded in our goals to double our men’s business, double our digital business, and quadruple our international business – to ultimately double our revenue from 2021 levels to $12.5 billion by 2026.”

International expansion, especially in mainland China, seems like where LULU is primed for the most growth opportunities.

Competitive Landscape

Moat and Competitive Advantage:

Lululemon's moat is its strong brand name, which gives it pricing power and customer loyalty. The company's high gross margins and ROIC reflect its competitive edge. Even with significant investment, it would be challenging for a competitor to breach Lululemon's moat due to its entrenched brand loyalty and market position.

Top Competitors:

The classics - Nike, Adidas, Under Armour, NewBalance

LULU has far better margins than these customers indicating a strong brand moat.

LULU has a much smaller market share than Nike, indicating there is a ton of room for growth, including potentially in footwear.

The new players - Alo Yoga, Vuori, and many more

This is the biggest threat to LULU as they strive to remain competitive.

Competitive Analysis:

Brand Loyalty: Lululemon has cultivated a loyal customer base, akin to Apple's brand loyalty.

Financial Fitness: Consistent revenue and profit growth with minimal debt.

Product Differentiation: High-quality, innovative products that command premium prices.

Survey Results: see below for Spring 2024 survey taken US among teens (source); additional quote: “Lululemon remains the No. 2 athletic apparel brand among upper-income teens (No. 1 among female upper-income teens), but we note that Alo Yoga was the No. 11 favorite brand and Vuori was the No. 15 favorite brand compared to No. 35 and No. 24 respectively in the fall.”

Financial Performance

Key Numbers:

We see all “greens” for the “Big 5” plus debt numbers for LULU. Phenomenal growth rates with only really sales slowing down a bit. Could be a concern if we were to nitpick. The stock’s price although it has dropped over 30% YTD might not have dropped far enough yet.

Lululemon's financials are robust, with high margins and strong cash flow. The company's gross margin is 58.3%, and its return on invested capital (ROIC) is 39% over the past year, indicating efficient capital utilization.

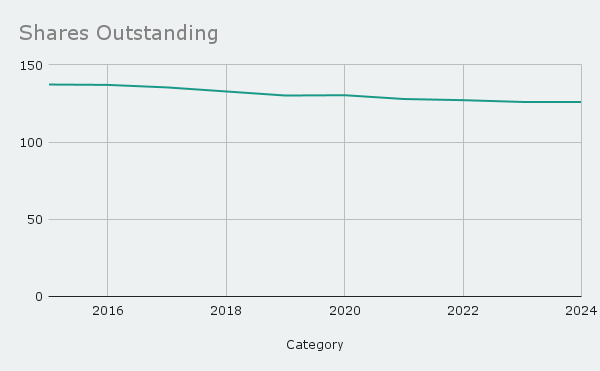

We also love to see the amount of shares going down. They have purchased at a fairly high price though, a potential flag.

Management and Leadership

CEO: Calvin McDonald

Background: Joined Lululemon in 2018, previously head of the Americas region at Sephora.

Commitment: Demonstrates strong leadership and strategic vision for growth.

Employee Satisfaction: High, with strong approval of the CEO and a positive corporate culture focused on personal responsibility, courage, and fun.

Risks

The retail space is tough to thrive in! Margins are hard to maintain, so are brand moats. Supply chains are easy to mess up. An idiot could not run this company. What if an idiot does one day? LULU does not have an unbreachable moat.

Other than that, here are the 3 main risks I see (one of which is very related):

Potential for poor international expansion

Here is a quote from their 10k: “Our future growth depends in part on our expansion efforts outside of the Americas. We have limited experience with regulatory environments and market practices internationally, and we may not be able to penetrate or successfully operate in any new market. In connection with our expansion efforts we may encounter obstacles we did not face in the Americas, including cultural and linguistic differences, differences in regulatory environments, labor practices and market practices, difficulties in keeping abreast of market, business and technical developments, and international guests' tastes and preferences. We may also encounter difficulty expanding into new international markets because of limited brand recognition leading to delayed acceptance of our technical athletic apparel by guests in these new international markets. Our failure to develop our business in new international markets or disappointing growth outside of existing markets could harm our business and results of operations.”

Rebuttal: This management team has executed well in the past, I see no reason why that would stop now.

Innovation A) Everyone starts to offer leggings at a low price - Will leggings become a ‘commoditized product’? B) If Lululemon starts competing in categories like running and footwear, it will directly compete with companies like Nike

Rebuttal: LULU has a strong brand now outside of leggings, especially in a growing male demo. Also, wearing lululemon is a status symbol. People buy a BMW when they could buy a Honda for a reason.

Rebuttal: This is a natural expansion of what LULU is doing. As the survey above shows, LULU is extremely popular, high quality gear. Shoes are just another avenue to continue the growth rate of sales.

Geo political risk with China

A significant portion of LULU’s revenue is in China, and it is the biggest area of growth

Rebuttal: If the west has problems with China, it will be a global issue that will affect the entire world, this is not unique to LULU.

Event

The stock has dropped recently due to the macro environment and its effects on the consumer. LULU has set expectations here, and aims to under promise/over deliver. Here are some details regarding missing guidance projections and a sluggish retail environment.

Valuation

We like to buy stocks at 50% off their “sticker price” whenever possible (see my POOL post for more links to the Rule 1 Style of investing for more info on that). With a brand like LULU, that might not ever be possible outside of a black swan-like event. That being said, despite LULU dropping 33% YTD (from $505 to $335) I’m looking for it to drop below $300 for me to feel comfortable jumping in.

“Sticker Price” or a fair value for LULU might be pretty close to what it’s trading for right now, closer to $350. Peter Lynch’s valuation model would price the stock around $320 for a fair price.

If LULU can continue to grow free cash flow (as it has for over ten years, and the rate is accelerating) than the stock could very well be worth well over $400 today. But that might be a big “if.”

Conclusion

Lululemon Athletica stands out in the Consumer Discretionary sector with its strong brand, robust financials, and strategic growth plans. Despite economic cycles, the company's focus on innovation, customer experience, and international expansion positions it well for long-term success. I think this is a wonderful company, but I’m not ready to buy it at this price yet.

Detailed analysis link here, including a nearly 100 point checklist!

Request for Feedback!

Am I way off about LULU? Do you love this company? Please comment below and let me know! A huge part of why I am doing this is to gather feedback from others.

Disclaimer:

Remember: This is not financial advice! I am not a financial advisor, nor have I taken your personal financial situation into account as your fiduciary. All of this is for educational and entertainment purposes only.